The library can define up to ten addresses for the borrower. Each of these addresses is given a name (i.e. Home Address, Address 2, Address 3, etc) and within each address, the library chooses which fields are “in use” – see the Borrower Definition Settings section for more details. For each borrower address that the library uses, the library can define which fields appear in the address and how these fields are formatted.

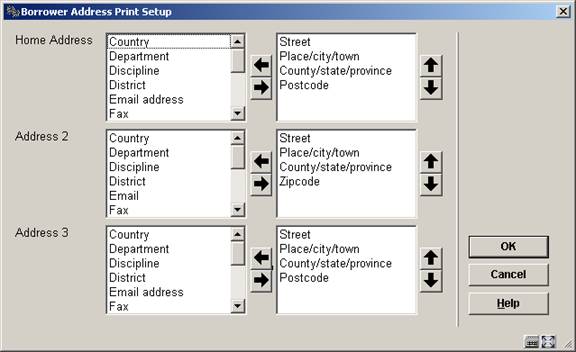

After choosing this option the following form will be displayed:

The form above includes each of the borrower address groups that is “in use” by the library. In this example, only three addresses are “in use”. For each group, the middle column shows the fields that are “in use”. These are the fields that the user can choose for the address print. To select a field, highlight it in the middle column and then push if over to the right hand column. Use the up and down arrows to change the order in which the fields display. When the fields have been selected for each address, press the OK button. The following form appears.

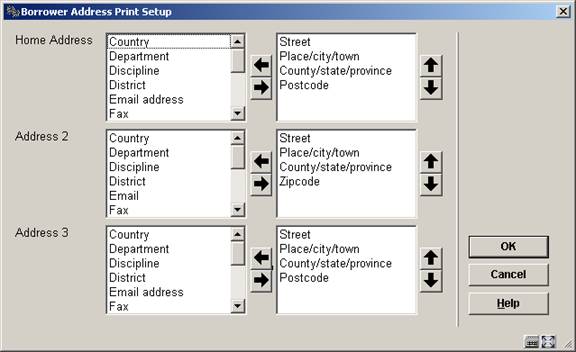

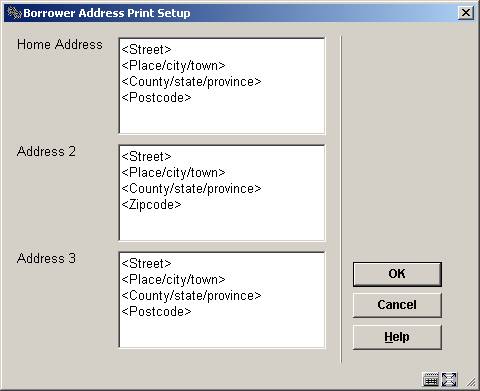

On this form, each of the selected fields appears within angle brackets. Do NOT remove the angle brackets from the field names.

“Borrower Address SSP Print Set-up” is used to set-up the way the address will be printed on all SSP notices and card format notices (overdue, reservations, manual/automatic recalls). This type of set-up allows multi line address printing. What you see in design mode is what will be printed.

·

For instance:

-

<Line 1>

-

<Line 2>

-

<Line 3>

-

<Line 4>

-

<Line 5>

-

<Place/city/town>, <District>

-

<Postcode>

- <Country>

See the section on Borrower Address SSP Print setup for a general explanation of this feature.

“Borrower Address Print Set-up” is used for all the other type of notices. In this set-up only three lines can be defined. The first line will be the street, the second line will be the city and the third line will be the postcode.

·

For instance:

-

<Street>

-

<Place/city/town>

- <Postcode>

· On each line you can define more than one element. For instance:

-

<Line 1> <Line 2>

-

<Place/city/town>, <District>

- <Postcode>

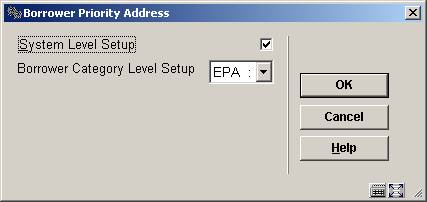

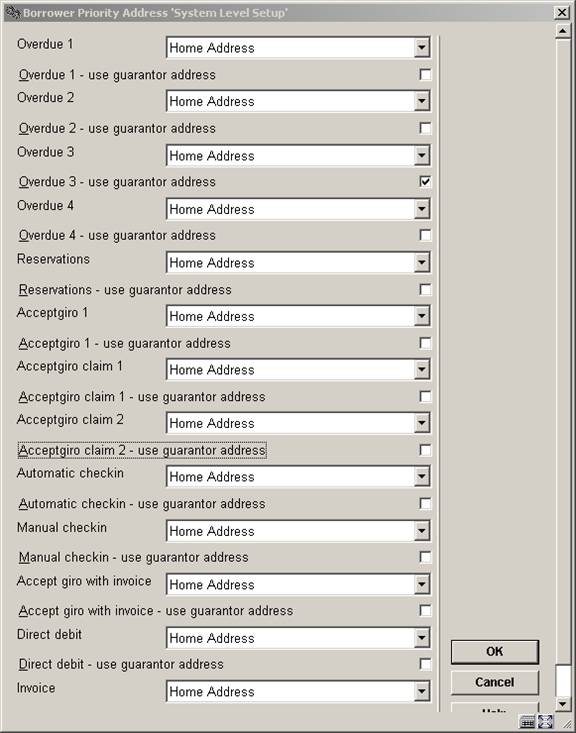

The Borrower address priority set-up is used to determine which borrower address should be used for each system job. There are 13 system jobs: Overdue 1 through 4, Reservations, the Accept/Giro jobs, etc. At the system level, for each of the 13 jobs, the library chooses which borrower address should be used for correspondence and whether the guarantor’s address (if found) should be used. The address priority set-up is also defined at the Borrower Category level. For each Borrower category, the library can choose, for each of the 13 system jobs, which borrower address should be used for correspondence.

Selecting ‘System level set-up’ results in the display of the following for:

For each job, the library can select which address should be used in correspondence. Also, if guarantors are used, the library can decide to override the borrower’s address with that of the guarantor for specific jobs. For example, the library might choose to send the 3rd overdue notice to the guarantor’s address.

Addresses can be set for: overdues 1-4, reservations, acceptgiro’s plus overdues, automatic & manual recalls, acceptgiro’s for invoices, direct debits, invoices, collection agency.

The set-up for a specific Borrower category, if done, overrides the more general system settings.

·

Logic for determining which address to use:

-

The system will check the address set-up at the system level to determine which address to use at the system level for the specific job.

-

The system set-up will be checked in order to see if this job uses the guarantor. If this job uses the guarantor and the borrower has a guarantor, the system will switch to the guarantor’s borrower record. If the borrower does not have a guarantor, the system will stay in the borrower’s record.

-

The system will check if there is an address set-up at the borrower category level. If there is, the system will use this set-up to determine which address to use for this job.

- If this address has “Use from” or “Use until” fields set, it will be checked to make sure that the selected address falls into the correct date range and also it will be checked that the “Use address for” field allows the use of this address for the specific job (if null, address can be used for anything). If this address is valid, starting from this address, the system will determine if there is another address that better qualifies for use (is “Use from” date after previous addresses but before today’s date). If no other address better qualifies for use, this address will be used. If this address is invalid, the system will start at the first address in the borrower record in order to find the address that qualifies best. If no address qualifies, the first address in use will be used.

In the left hand column all address groups in use are displayed.

After choosing this option the following form will be displayed:

· The fields that should be part of the 1 line address display can be moved to the right. The order of the fields can be modified by using the up and down arrows.

In AFO 431, Borrower Administration you have the option to create additional cards for a borrower record. The maximum number of additional cards that can be added is limited by this parameter

After choosing this option the following form will be displayed:

· Enter the maximum for each borrower category.

Note

If nothing has been defined, no additional cards can be created. The relevant button will be inactive on the screen in AFO 431, Borrower Administration.

·

In case there are more than 15 borrower categories, there will be a button to go to the next screen.

· The button allows you to go directly to a specific borrower category.

You can create age groups and relate these to one or more borrower categories. If a borrower category is changed in AFO 431 the system will check the valid categories that correspond to the age of the borrower. If the borrower category is not valid, an error message is displayed. If a borrower category is changed in AFO 431 the system will check the valid categories that correspond to the age of the borrower. If the borrower category is not valid, an error message is displayed.

After choosing this option the following form will be displayed.

·

Add an age group and move the valid category to the right.

If the table contains no entry at all, no age check will be done.

Ages that do not fall in any of the defined age groups have no restrictions on borrower category (i.e. all categories are valid).

Example table:

|

Age group |

Valid categories |

Comments |

|

0-4 |

A,B,C |

|

|

4-12 |

D,D2 |

|

|

13-17 |

E,F,G,H |

|

|

18-64 |

I,J,K,L |

|

|

65-999 |

I,J,M |

Note that borrower categories may appear in multiple age groups (I and J also appear in the previous age group) |

|

* |

X,Y,Z |

No date of birth in the borrower record |

|

+ |

T1,T2 |

Categories that are valid in all cases, independent of whether they figure in age groups. This parameter takes precedence over age related parameters. |

|

- |

T3 |

Categories that are invalid in all cases, independent of whether they figures in age groups. This parameter takes precedence over age related parameters. |

Note

When the system is configured is such a way that an age can fall in multiple categories, the internal global will contain the result of an OR operation. Example:

·

The age categories

-

0-4 – category A,B,C

-

0-6 – category C,D,E,F

·

correspond to the following ages:

-

0 – A,B,C,D,E,F

-

1 – A,B,C,D,E,F

-

2 – A,B,C,D,E,F

-

3 – A,B,C,D,E,F

-

4 – A,B,C,D,E,F

-

5 – C,D,E,F

- 6 – C,D,E,F

When codes have already been defined, an overview screen will be displayed:

: Select this option to enter a new code. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a code and then this option to modify the code.

:Select a code and then this option to delete the code.

Note

This parameter has no relation to any other age category related parameters.

If your library is set up to generate pincodes from date of birth, you can use this option to automatically generate pincodes based on date of birth for borrowers without pincodes when you leave the borrower’s record in AFO 431. These parameters are set at the metaInstitution level.

After choosing this option the following form will be displayed:

Automatically generate pincode from date of birth: set this flag if you wish to automatically generate pincodes when you leave the borrower’s record in AFO 431. This flag should only be set if your library generates pincodes from the date of birth field.

Default pincode if date of birth is not available: enter either a valid date or 99/99/9999.

If the automatic generate flag is set and your PIN generation is based on DateOfBirth and the borrower does not already have a PIN code, the system will automatically generate a pincode (using either the borrower’s date of birth or the default in defined above) when you leave the borrower's record.

Pincodes may also be automatically generated for borrowers entered through the WebOpac.

If you have selected to display the district code for the Data to be entered and Data to be corrected options in AFO 482, a dropdown list will be displayed when adding/modifying a borrower record. This parameter determines what the dropdown list looks like

After choosing this option the following form will be displayed:

District display includes: choose a format from the dropdown list. There are four options:

- only code

- only wording (gives nothing if district is not in authority)

- code followed by wording

- wording followed by code

Punctuation between code and wording: When you choose option 0 or 1 you can specify here what the punctuation between code and wording must be.

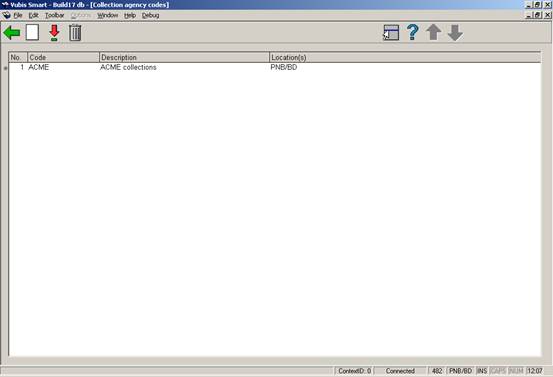

These parameters are stored at the Circulation metainstitution level. Multiple collection agency codes may be set up for each Circulation metainstitution.

After choosing the Collection agency codes option, a screen appears showing you all of the collection agency codes already set up for your Circulation metainstitution:

: choose this option to create a new code. See section 482.34.1.

: choose a code and then this option to modify the details. See section 482.34.1.

: choose a code and then this option to delete the code.

After choosing the or option an input form will be presented:

Collection code: a unique code for this collection agency. When updating an existing code, this field will be protected (i.e. once a code has been added, you can not modify the code itself).

Description: a brief description of the collection agency.

Locations to link: combo box showing list of institution/location combinations (including institution/* to select all locations for a specific institution). If an institution/location combination is already linked to another collection agency code, the list will not include this combination. Select a location and use the arrows to move it.

Exempt fee types: combo box showing list of fee types that are not collected by the collection agency. Select a fee type and use the arrows to move it.

Monetary threshold: If a Borrower's aged aggregate amount owed (see Aging and Grace period parameter below) equals or exceeds this value, the Borrower's bills and invoices will be sent to the Collection Agency for collection. The aggregate amount is calculated only from fee types not included in the Exempt fee types field.

Collection fee: On going to collection, an additional processing fee will be added to the existing invoices.

Aging parameter (in days): (i.e. 6 years = 2189). Invoices, fines and other payable amounts older than this criteria will be ignored.

Grace period (in days): (ignore current invoices within X days). Invoices, fines and other payable amounts more recent than this will be ignored.

Exempt borrower categories: list of borrower categories that are exempt (e.g.: Staff, Bankruptcy). Select a borrower category and use the arrows to move it.

Email address: enter the email address of the Collection Company to which reports must be sent.

·

Document control - Change History

|

Version |

Date |

Change description |

Author |

|

1.0 |

March 2006 |

creation |

|

|

2.0 |

May 2006 |

updates for release 2.4.1 build 16 |

|

|

3.0 |

September 2006 |

updates for release 2.4.1 build 17 |

|

|

4.0 |

November 2006 |

changed terminology; added explanation of language code usage |

|

|

5.0 |

April 2007 |

added more info on borrower name display |

|

|

6.0 |

May 2007 |

minor updates |

|

|

7.0 |

November 2007 |

added explanation of how to set block type 13 ("Items returned too late") delivered as part of 2.4.2.4 updates |

|